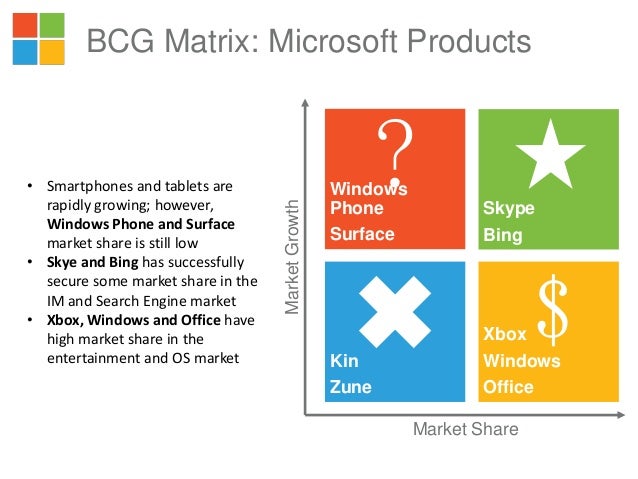

It depends on how you apply the matrix and in which context, but the Boston Consulting growth-share matrix aids the company in deciding which products or units to either keep, sell, or invest more in. The BCG matrix or the Boston Consulting group Growth Share matrix is a planning tool used internally by management to decide which products are the most profitable and which ones to invest in as well as which ones to sell or divest. The matrix includes a graphical representation of the company’s products and product categories in the form of. The BCG matrix is a strategic management tool that was created by the Boston Consulting Group, which helps in analysing the position of a strategic business unit and the potential it has to offer. The matrix consists of 4 classifications that are based on two dimensions. These first of these dimensions is the industry or market growth. Contemporary business strategy of Microsoft Corporation has been analyzed through product lifecycle and BCG matrix. As stated by Kang (2012), product lifecycle and BCG matrix is the very important as well as essential element in order to indicate the contemporary business strategy of this Microsoft Corporation. Microsoft Ansoff Matrix is a marketing planning model that helps the multinational technology company to select its product and market strategy. Ansoff Matrix distinguishes between four different strategy options available for businesses. These business growth strategies are market penetration, product development, market development.

The BCG Model is based on the product life cycle theory that can be used to determine what priorities should be given in the product portfolio of a business unit. To ensure long-term value creation, a company should have a portfolio of products that contains both high-growth products in need of cash inputs and low-growth products that generate a lot of cash. It has 2 dimensions: market share and market growth. The basic idea behind it is that the bigger the market share a product has or the faster the product's market grows the better it is for the company.

Placing products in the BCG matrix results in 4 categories in a portfolio of a company:

1. Stars (=high growth, high market share)

- use large amounts of cash and are leaders in the business so they should also generate large amounts of cash.

- frequently roughly in balance on net cash flow. However if needed any attempt should be made to hold share, because the rewards will be a cash cow if market share is kept.

2. Cash Cows (=low growth, high market share)

- profits and cash generation should be high , and because of the low growth, investments needed should be low. Keep profits high

- Foundation of a company

3. Dogs (=low growth, low market share)

- avoid and minimize the number of dogs in a company.

- beware of expensive ‘turn around plans’.

- deliver cash, otherwise liquidate

4. Question Marks (= high growth, low market share)

- have the worst cash characteristics of all, because high demands and low returns due to low market share

- if nothing is done to change the market share, question marks will simply absorb great amounts of cash and later, as the growth stops, a dog.

- either invest heavily or sell off or invest nothing and generate whatever cash it can. Increase market share or deliver cash

Bcg Matrix Of Microsoft Company Background Template

The BCG Method can help understand a frequently made strategy mistake: having a one-size-fits-all-approach to strategy, such as a generic growth target (9 percent per year) or a generic return on capital of say 9,5% for an entire corporation.

In such a scenario:

A. Cash Cows Business Units will beat their profit target easily; their management have an easy job and are often praised anyhow. Even worse, they are often allowed to reinvest substantial cash amounts in their businesses which are mature and not growing anymore.

B. Dogs Business Units fight an impossible battle and, even worse, investments are made now and then in hopeless attempts to 'turn the business around'.

C. As a result (all) Question Marks and Stars Business Units get mediocre size investment funds. In this way they are unable to ever become cash cows. These inadequate invested sums of money are a waste of money. Either these SBUs should receive enough investment funds to enable them to achieve a real market dominance and become a cash cow (or star), or otherwise companies are advised to disinvest and try to get whatever possible cash out of the question marks that were not selected.

Some limitations of the Boston Consulting Group Matrix include:

High market share is not the only success factor

Market growth is not the only indicator for attractiveness of a market

Sometimes Dogs can earn even more cash as Cash Cows

Book: Carl W. Stern, George Stalk - Perspectives on Strategy from The Boston Consulting Group

T I P : Here you can discuss and learn a lot more about the BCG Matrix.

Compare with the BCG Matrix: GE / McKinsey Matrix | ADL Matrix | Core Competence | Bass Diffusion model | Relative Value of Growth | STRATPORT | Profit Pools | Product Life Cycle | Blue Ocean Strategy | Four Trajectories of Industry Change | Positioning

Microsoft Ansoff Matrix is a marketing planning model that helps the multinational technology company to select its product and market strategy. Ansoff Matrix distinguishes between four different strategy options available for businesses. These business growth strategies are market penetration, product development, market development and diversification.

Microsoft Ansoff Matrix

Microsoft uses all four strategy options within the scope of Ansoff Growth Matrix in an integrated way.

1. Market penetration. Market penetration refers to selling existing products to existing markets. Microsoft uses market penetration strategy to sell its Windows software and devices and other products in 116 Microsoft stores worldwide as well as through online channels and authorised distributors. The multinational technology company uses Microsoft Rewards loyalty program to pursue its market penetration strategy.

2. Product development. This growth strategy involves developing new products to sell to existing markets. Microsoft engages in product development strategy systematically. The tech giant’s research and development expenses increased USD 1.7 billion or 13% in 2018 compared to the previous year.[1]

Microsoft develops most of its products and services internally through three engineering groups.

- Applications and Services Engineering Group, focuses on broad applications and services core technologies in productivity, communication, education, search, and other information categories.

- Cloud and Enterprise Engineering Group, focuses on our cloud infrastructure, server, database, CRM, enterprise resource planning, management, development tools, and other business process applications and services for enterprises.

- Windows and Devices Engineering Group, focuses on our Windows platform across devices of all types, hardware development of our devices, and associated online marketplaces.

3. Market development. Market development strategy is associated with finding new markets for existing products. Microsoft enters a new market whenever it sees there potential for its products and services. For example, HoloLens was made initially available only in 10 countries such as United States, United Kingdom, Canada, Australia and Germany. Once demand for this product increased in the global scale, the company made HoloLens available to an additional 29 markets with comparably lesser purchasing power such as Croatia, Poland and Turkey starting from November 2017.[2]

4. Diversification. Diversification involves developing new products to sell to new markets and this is considered to be the riskiest strategy. Microsoft uses diversification strategy occasionally. Entering the cloud business in 2006, the same year as its rival Amazon launched Amazon Web Services can be mentioned as the most notable example of diversification strategy engaged by Microsoft. This bet proved to be highly successful though.

By October 2018, Microsoft surpassed Amazon in 12-month cloud revenues, becoming an undisputed leader in cloud in the global scale. Specifically, while Microsoft earned USD 26,7 billion revenues, Amazon’s revenues totalled to only USD 23,4 billion for the same period.[3]

Microsoft Corporation Reportcontains a full analysis of Microsoft Ansoff Matrix. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on Microsoft. Moreover, the report contains analyses of Microsoft leadership, business strategy, organizational structure and organizational culture. The report also comprises discussions of Microsoft marketing strategy, ecosystem and addresses issues of corporate social responsibility.

[1] Annual Report (2018) Microsoft Corporation

[2] Bowden, Z. (2017) “Microsoft is bringing HoloLens to 29 new markets starting today” Windows Central, Available at: https://www.windowscentral.com/microsoft-bringing-hololens-29-new-markets-starting-today

Microsoft Company

[3] Evans, B. (2018) “#1 Microsoft Beats Amazon In 12-Month Cloud Revenue, $26.7 Billion To $23.4 Billion; IBM Third” Forbes, Available at: https://www.forbes.com/sites/bobevans1/2018/10/29/1-microsoft-beats-amazon-in-12-month-cloud-revenue-26-7-billion-to-23-4-billion-ibm-third/#510bdfb82bf1